Tips and Tools to Start a Budget

Tips and Tools to Start a Budget

Step 1: Develop a financial plan

- Understand your income and expenses

- Be aware of your pay days each month; know your total monthly income

- Know your payment due dates for bills and understand your total monthly expenses

- Categorize spending - groceries, dining out, clothing - to understand where you are spending your money

- Identify needs vs wants

- Identify patterns of spending throughout the month

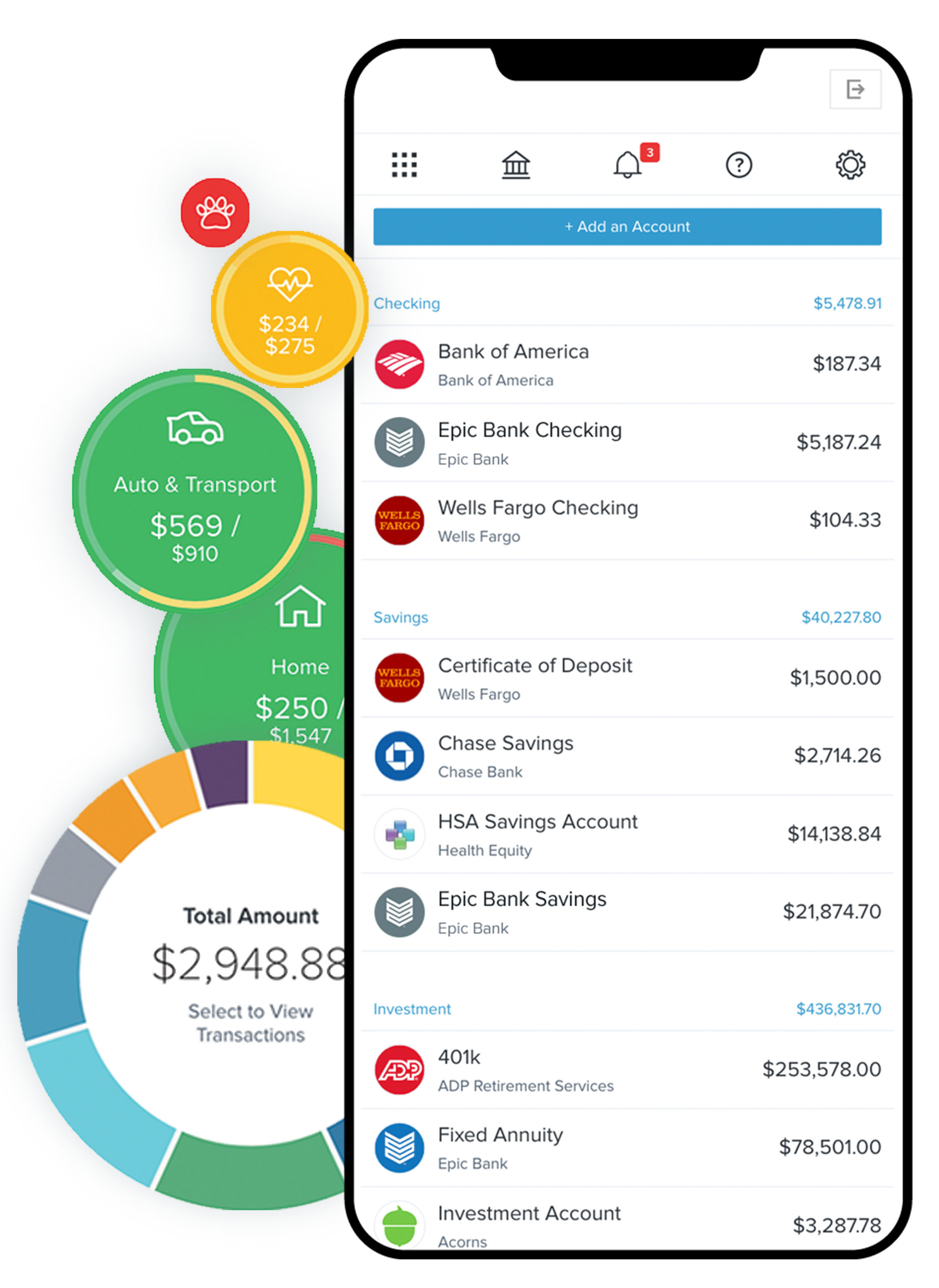

Money Manager

Track your spending, create and manage budgets, add accounts from other financial institutions, set financial goals, and receive notifications on your progress!

Money Manager is a personal financial management tool available to all CSB customers within online banking. It provides visual representations of where your money is being spent and where it can be saved. You are also able to link non-CSB accounts to allow for better insight to all of your accounts in one place (ex: retirement account, credit card, student loans).

Step 2: Set Goals

Setting goals will help you narrow down what you need to save for first.

- Pay off debt

- Save for car down payment

- Save for vacation

Have trouble with impulse buys? Ask yourself these questions:

- How much is the item? Example: The newest phone - $900

- How many hours at work would it take in order to pay for that item? Example: If you work for $10 an hour after taxes. Then it would take about 90 hours to make $900 to pay for the phone.

- Is it worth your time? You work hard for your money. Can it be better spent or saved somewhere else? Example: Your current phone is only a year old and is working great.

Step 3: Take Action

- Save automatically! Set up automatic, recurring transfers to your savings account.

- Pick a target date to payoff debt! Calculate how much you need to pay each month to hit your target date. Check out our Credit Card Payoff Calculator to get started.

Popular methods for paying down debt:

The Avalanche Method

- Make the minimum payment on all of your accounts

- Put as much extra money as possible toward the account with the highest interest rate

- Once that debt is paid off, begin paying the extra money toward the account with the next highest interest rate

- PROS - You pay less in interest and you will get out of debt more quickly

- CONS - It takes longer to see progress

The Snowball Method

- Make the minimum payment on all of your accounts

- Put as much extra money as possible toward the account with the smallest balance first

- Once that debt is paid off, begin paying the extra money toward the account with the next lowest balance

- PROS - If you have several small debts to payoff, this method helps you gain small wins very quickly

- CONS - You could end up paying more in total due to the interest accumulating on the accounts with higher interest rates

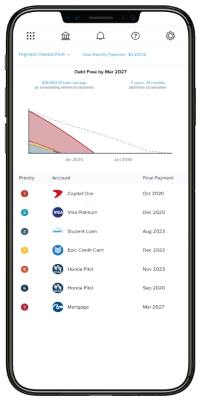

Money Manager - Understanding Debts

Visualize the best way to manage your debt.

With Money Manager, users are able to unlock the power to link credit cards, loans, and student debt in one place to strategically plan for the best and fastest way to pay off debt.

Step 4: Review Progress

- Celebrate your victories! When you have a win, reward yourself.

- Own your overspending (impulse buys) and adjust your budget.

- Make changes as needed; your plan must be flexible.

Helpful Resources

Find the way that works best for you. Everyone is different, but whether its on paper, completely digital, or somewhere in-between making and keeping a budget is very important.

Apps to Stay on Track

Save money on everyday items

- MyPlate - Tips and a meal planning worksheet template

- Budget Bytes - Find easy and tasty recipes on a budget

- GasBuddy - Search for the best deals on gas

- Ibotta.com - Save money on groceries

Prepared for informational purposes only.